Dodd-Frank Clawbacks: Backcasting to Measure Recoupment

The SEC initially proposed clawback rules for executive compensation on July 1, 2015, and released final rules over seven years later, on October 26, 2022. The rules stem from the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). They functionally require companies to develop and enforce policies to recover incentive-based compensation in the event of a financial restatement that alters how much value would have been delivered had the error never occurred.

The new Dodd-Frank clawback applies to all flavors of incentive compensation. That includes accounting metrics (performance conditions) and stock price or total shareholder return (TSR) metrics (market conditions). In contrast to the clawback provisions required under Sarbanes-Oxley that require evidence of fraud, Dodd-Frank clawbacks are “no fault” and will be triggered by materially misstated financials. Both Big-R and little-r restatements are triggers. Annually, approximately 4-5% of companies encounter some order of restatement.

The new clawback rules will likely prove troublesome, especially given all the varieties of share-based payment awards outstanding.

In this blog post, we discuss one of the more common approaches for determining the amount of compensation to claw back in the event of a restatement where the incentive-based compensation is based on stock price or a TSR metric. In these cases, there is not a simple recalculation of the correct equity compensation payout using the corrected financial results. Instead, a potentially complex modeling exercise must be performed to estimate what the stock price or TSR trajectory would have been had the restatement never occurred.

Given the possible complexity of the process and the sensitivity associated with recovering compensation from a group of senior executives, our goal here is to shed light on the mechanics of how this process could unfold.

Correcting the Underlying Metrics

For awards that vest based on performance metrics, such as earnings or revenue targets, simply determine how much less compensation would have been paid using the restated values had those values been correctly reported in the first place. For awards vesting based on market metrics, the remeasurement is much more complex. After finding a misstatement, the company must determine what its stock price or return would have been had the financials initially been properly stated.

The SEC rule states that an issuer is permitted “to use any reasonable estimate” of the effect of the restatement on stock price and TSR.[1] The SEC also suggests that one method that companies could use is an event study to isolate the adjustment due to the misstatement, similar to what is “often used in accounting fraud cases to determine the effects of corrective disclosure on the market price of an issuer’s stock.”[2]

Here we discuss several event study methodologies for calculating the “but-for” stock price for a company, or the stock price that would have been if financial statements originally had been presented as later restated.

One common way to calculate a but-for stock price is called “backcasting.” This approach has two steps:

- Adjust the stock price as of the date the misstatement is revealed. This is where an event study comes into play in order to disentangle the offsetting effects of the various factors pushing and pulling the stock price. For example, if the restatement is announced at the same time as a positive earnings surprise, the analytical framework is used to try and isolate the effect of the restatement only

- With the but-for price at the end of the period known, use company performance, market factors, and/or industry factors to fill in the hypothetical prices during the misstatement period

This will allow estimation of the price inflation at each date, or the amount by which the stock’s trading price was above the but-for price.

Using an Event Study

When using an event study to interpret a stock price drop, objective and well-documented analysis is essential to minimize the risk of disputes over the method. Event studies are open to charges of subjectivity because different experts using different methodologies may come to different conclusions about how much of a decline the misstatement caused. The most likely challenge would be a shareholder-led lawsuit alleging that the board failed to adopt a reasonable method in effectuating the clawback. The executive might also retain an expert to allege the amount clawed back was excessive.

There is also a key difference between how event studies are used in standard shareholder litigation versus clawback enforcement. In litigation, the plaintiffs (often a group of shareholders) are looking to maximize recovery and the company is trying to prove the opposite. However, in a clawback analysis that seeks to re-specify equity compensation delivery, litigation risks come from different angles. The impacted executives may allege the clawback is excessive and the upset shareholders may allege the clawback is insufficient because the board failed to uphold its fiduciary duty. That’s before we consider the obvious public relations conundrum if the recovery amount is later shown to have a downward bias.

In fact, the SEC specifically flags the risk of bias we discussed earlier by acknowledging that management can couple the release of bad news with unrelated good news, thereby diluting and obfuscating the calculation in a self-serving manner. This SEC in particular is very concerned about opportunistic uses of information. In any event, methodological rigor and process clarity are essential to estimating a defensible clawback amount if the situation were to arise.

Case Study: XYZ Corp.

To illustrate several measures that can be used, let’s consider a hypothetical company, XYZ Corp.

- On July 1, 2020, XYZ Corp.’s stock was trading at $70 per share

- That same day, XYZ Corp. granted to its CEO restricted stock that would vest if the company’s common stock traded above $100 per share at any time during the 18-month performance period ending December 2021

- In June 2021, the stock price increased above $100 for the first time, causing the shares to vest

- The stock price increased to a maximum price of $121 in August 2021

- At the end of March 2022, the stock closed at $100. Shortly after, the company announced that it needed to restate earnings for calendar year 2021, beginning January 1, 2021, and lowering earnings by $1 per share over this period. The stock fell $20 to a price of $80

Understanding the Price Drop

To understand the price drop attributable to the misstatement, first we consider the amount of inflation in the stock price at the date the misstatement was revealed. A starting assumption is that the inflation in this price was $20 (the amount the stock fell when the misstatement was announced). There are a few reasons why this whole drop may not be consistent with the difference between where the stock was and where it would be with no misstatement:

- The drop in XYZ’s stock price may be partially because of drops in the market and industry factors rather than the restatement

- The drop in XYZ’s stock price may be a response to other factors related to the misstatement (like reputational damage due to the misstatement)

- The stock drop may be due in part to other confounding information announced at the same time. Alternatively, the stock drop may be reduced if the timing of the misstatement is tied to good news about the company

A properly conducted event study will look at these factors to see which ones apply and to what extent they’re influencing XYZ’s stock price drop at the misstatement date. The goal is to isolate just the impact of just the restatement. This can be done by analyzing the historical relationship between the issuer’s equity returns and market and industry returns. It’s also common to analyze news and public commentary about the company on the date the information was released to understand the broader environment affecting equity prices. Further, if information about the misstatement was released on multiple days (e.g., a time lag between when the misstatement was announced and when the restated numbers were released), the event study analysis must be done on each date to aggregate the cumulative effect of the information dosing.

The event study must also take into consideration how long it took the market to fully incorporate the negative news about the restatement. In Big-R restatements, there may be a lag between the time the company issues its Item 4.02 Form 8-K stating that prior financials cannot be relied upon and the time it formally reissues those financials.

Determining the But-For Stock Price through the Misstated Period

After a company has performed an event study analysis resulting in the correct price at the end the period, it needs to understand what the but-for price would be throughout the period where the earnings were misstated. Thus, the next step is to trace from right to left, starting at the restatement and building a stock price trajectory back to the time of the misstatement. In our examples, assume that XYZ has attributed the full $20 stock price drop to the misstatement.

The first hypothetical model of the stock price movement assumes that the stock price at the end of the period, after movements related to the revelation of the misstatement, was the appropriate price throughout the period.

After it’s established that the stock price should have been $80 on the date that the misstatement was finalized, XYZ needs to consider whether the stock price would have increased above $100 at any time during the performance period.

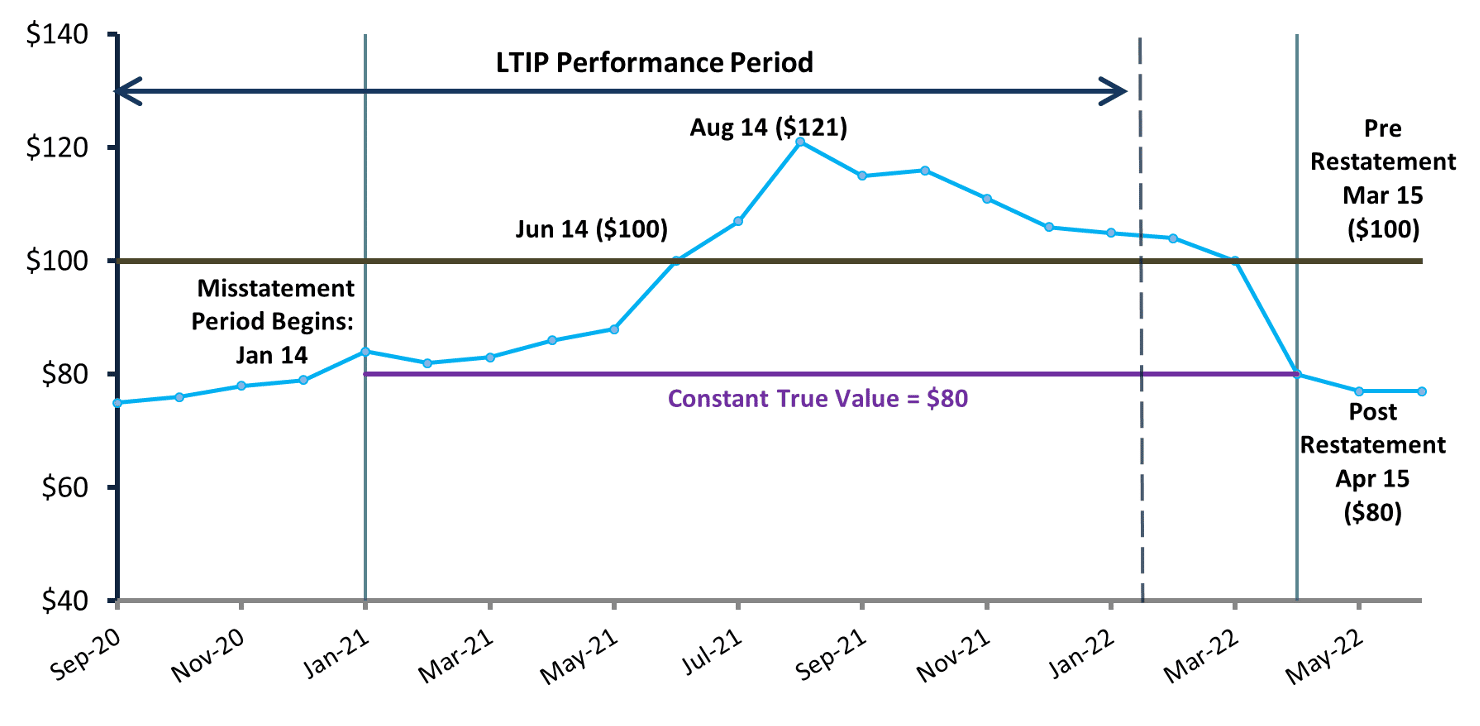

The first method a company may consider is the constant true value method (Figure 1). Under this model, the value after the misstatement is considered the correct value of the company at any time. This model lacks flexibility and fails to account for other changes in the company and business conditions.

For example, had the stock price increased to $150 after the performance period and fallen to $130 after the restatement, the award wouldn’t be clawed back because the assumption would be that the stock price should have been $130 throughout the misstated period. But this fails to consider the web of factors that influence a stock price. Over time, a stock moves in relation to macroeconomic factors affecting all companies, industry factors that impact the company and its peers, and company-specific factors. A company’s goal should be to incorporate these factors into the but-for calculus while removing the price inflation due to the misstatement.

Figure 1: Constant True Value Method

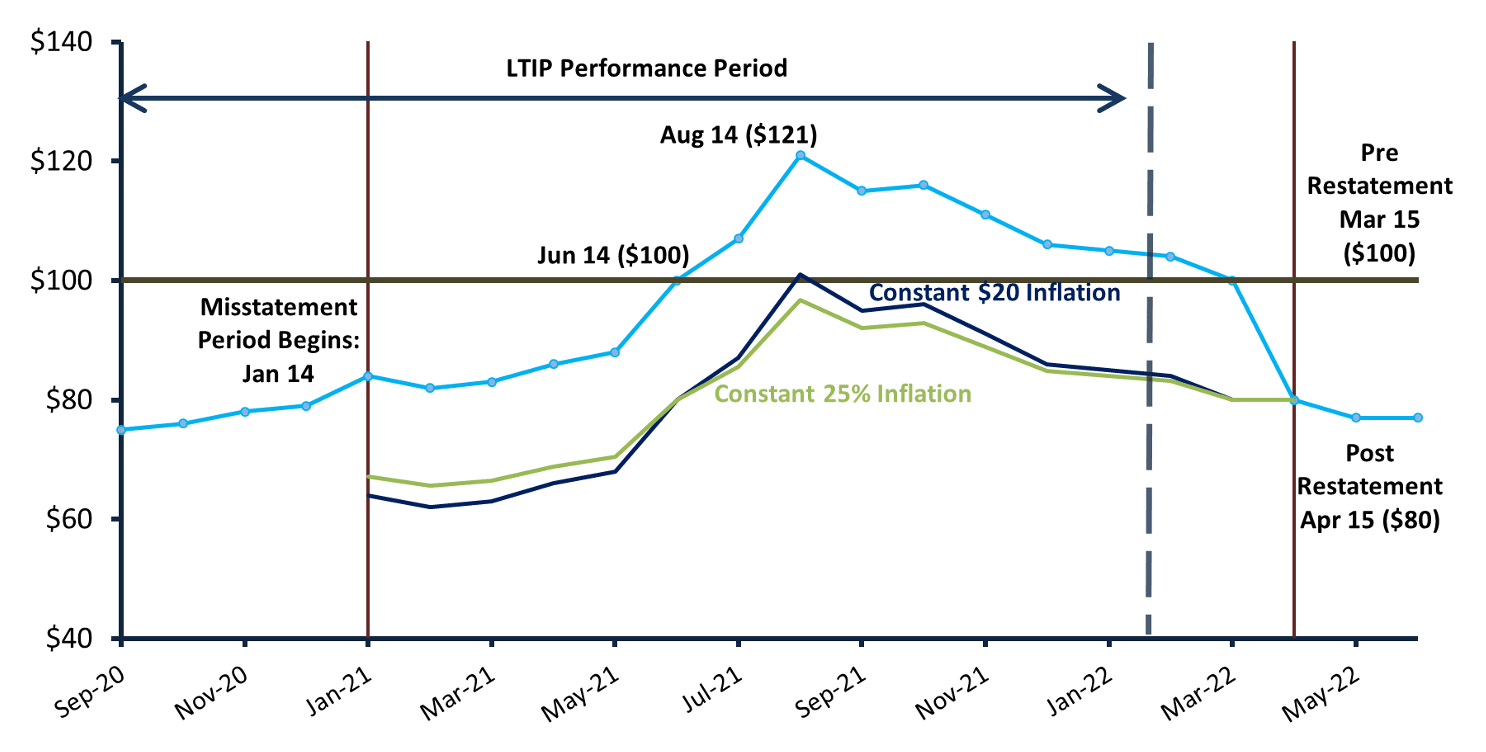

In order to incorporate all other factors that affected the stock, a company may elect to use a “constant difference” approach (Figure 2). This method assumes that the stock was overpriced by the same amount throughout the period. This can be done in percentage or dollar terms. If a constant dollar difference is used, XYZ’s stock would be assumed to be $20 too high over the misstatement period. In this case, the highest price would be $101 and the award would still have vested. Alternatively, XYZ could assume the price was overstated by 25% at all times during the misstatement. Under this assumption, we see that the award wouldn’t have vested had the earnings been correctly stated.

Figure 2: Constant Dollar and Percent Difference Method

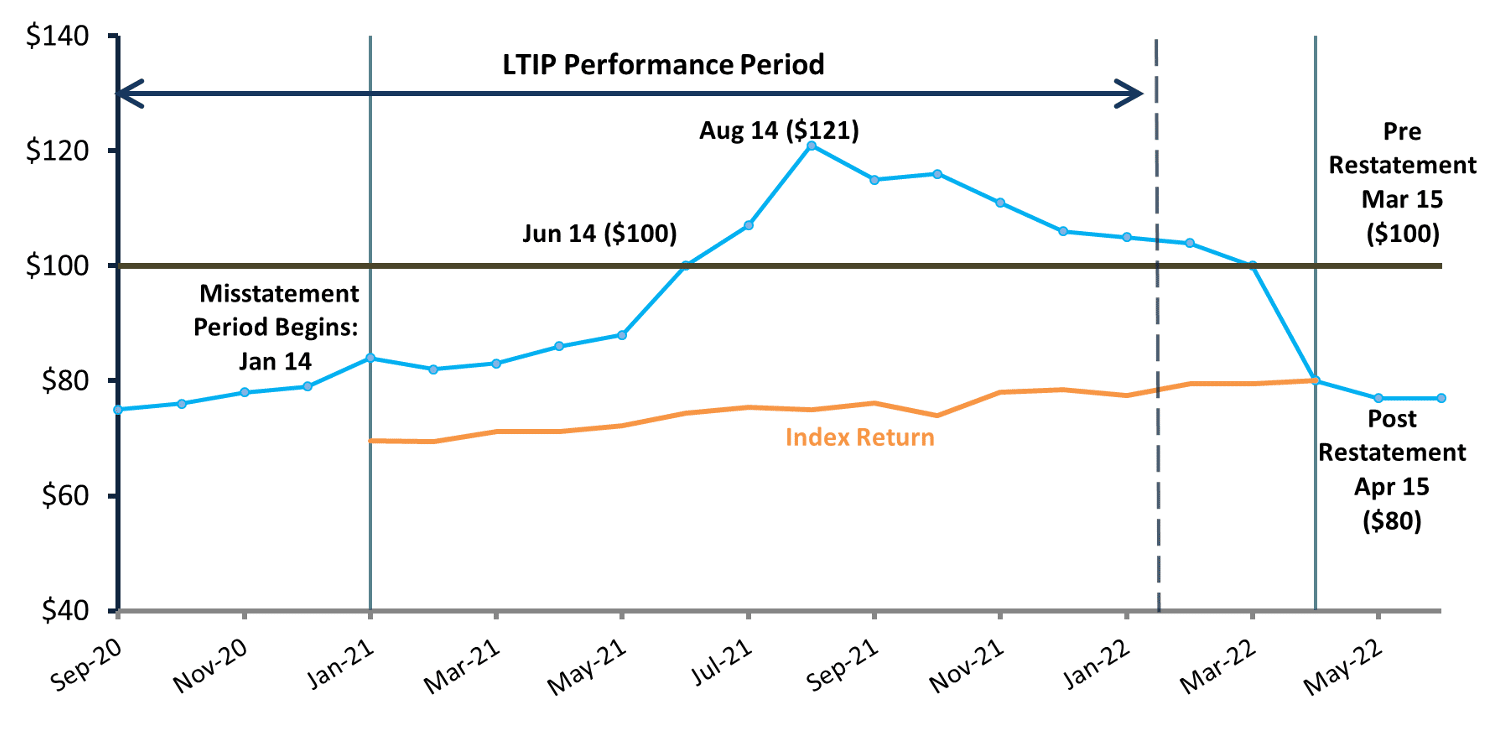

A company also may decide that none of its returns are usable and it must rely only on the information from peer companies and broader market indices (Figure 3). In these index methods, the company’s but-for returns are built using its historical relationship with some combination of a market index and the returns of peer companies. Generally, a company should aim to use a period unaffected by the misstatement to build the relationship, or alternatively use a simplified model. Here, XYZ’s but-for stock price is shown, assuming their returns over the misstatement period correlate to those of the S&P 500.

Figure 3: Market Return Method

Because the purpose of TSR awards is to reward companies for value creation, it seems unlikely that a model that removes the company-specific portion of the return would be appealing. This approach also may potentially suffer from a high degree of market-related noise.

As such, we expect that the constant dollar or percentage drop methods will usually be the most appropriate to use when determining the amount of incentive-based compensation to recover when there is a stock price or TSR metric. Of course, there are many variations on how each model is developed. The task of the specialist performing the analysis is to balance a model’s complexity and nuance against the clarity and objectivity of the model’s underlying assumptions.

What about working forward instead of backward?

In our case study, we discuss a backcasting approach, starting with a price adjustment at the end of the period and working backward to fill in the misstatement period. Alternatively, a company could use a clean price from before the misstatement and forecast the future returns from this price. In this case, constant dollar or percentage methods don’t apply because there’s no stock price drop to model.

Instead, the task is to assess what artificially inflated impact the incorrectly issued financials had on the stock price at the time they were issued. For instance, suppose the company beat the street’s consensus earnings estimate—but using the correct financials, they would have met earnings expectations. In this case, a model is developed to assess how the stock price would have fared under a mere “meets expectations” outcome. Event studies using data from other industry firms could inform such an assessment.

Another approach could be to use an index-based method, though this would suffer even more from the concerns we noted above.

What if the returns to other companies matter?

In many cases, a company’s share-based payment award will depend on the returns of the issuing company in relation to the returns of a group of peers or an index (the relative TSR, or rTSR, award design). An event study should generally work in this context. Typically, it will make the most sense to leave the returns of the comparison group firms unchanged.

In some cases, a restatement may be so severe that other firms in an industry are also affected. In this case, a key consideration is how to treat the returns of these other firms.

More importantly, these rTSR award designs typically have fixed performance start and end dates. This means the contours of the backcasting exercise really matter, since it’s generally a 30-day average stock price performance at the end of a three-year period that informs the payout.

What about little-r restatements?

Little-r restatements don’t involve a reissuance of the financials, but rather, updating prior period values in a newly published set of financials. Unfortunately, this will make the analysis even more complex since more moving parts are sandwiched into the same information release. For example, what if the company beats the current period consensus estimate, but updates prior period results that causes those results to lag what the street had expected in those prior periods? Further, suppose the stock price drops only a few percentage points at the time of release, then two days later the company announces its CFO will be departing and the stock price drops another 10%.

Generally, the stock price drop linked to a CFO departure signals that another shoe could drop. But from a compensation recovery perspective, there’s a presumption of innocence until guilt is proven—i.e., the shoe first needs to drop and we can’t factor in expectations. The event study needs to focus just on the results that have actually been updated. But even so, it will prove difficult to disentangle the beneficial signaling of beating current period earnings estimates from the negative news that prior period results were overstated.

How should companies prepare?

While nobody anticipates needing to effectuate a clawback due to a restatement, there are some steps companies can take now to prepare for the possibility.

First, tell the compensation committee and appropriate members of executive management what happens during an event study and how a clawback is computed in the context of stock price metrics.

Next, work with legal counsel to decide how the mandatory Dodd-Frank clawback policies will interact with existing clawback policies. Ostensibly, the board will wish to maintain existing policies and their benefits (which usually entail further reach but board discretion as to enforcement). That means companies will either have two separate policies or a single policy with bifurcated language.

Finally, in drafting Dodd-Frank clawback policies, work with legal counsel to ensure flexibility in how to calculate the clawback amount and to shut the door on disputes stemming from the methodological flexibility the SEC affords in calculating the clawback amount for stock price or TSR cases.

If you would like to discuss any of the ideas here or would like to back-test how a prior restatement may have been handled under the new guidance, please don’t hesitate to reach out to us.

[1] SEC release, p. 63.

[2] SEC release, p. 144. The SEC notes that event study methodologies would be “anchored on objective and commonly accepted practices by the industry and relevant literature.” While the SEC doesn’t state a specific preference for an event study, it’s the only method discussed in the release. What’s more, the SEC discusses it using procedures derived from objective standards that may lower the likelihood of a challenge to the firm’s clawback conclusion, reflecting a lean in the direction of support for the method.